The shortage of power management ICs that began in July last year has lasted for three quarters, and downstream electronics manufacturers are still actively looking for goods to stock up.

From the rapid increase in downstream consumption, the elimination of the original production capacity of the head factory and the transformation of channels have led to the concentration and reduction of supply, the superimposed epidemic and disasters have blocked the flow of materials, and the industry has always been in chaos such as false quotations for roasted seeds and nuts. One of the most serious categories...

Power management IC rises by another 10%! Xiaomi lacks material internal cutting project

News from the supply chain, due to the explosive quantity of terminal materials and the "bullwhip effect", TI’s power management IC, which has the most sufficient capacity, is also facing a large shortage of goods. The spot price of agent traders has increased by 20-30 % Range, small customers basically can not get the spot; ADI closely, some power IC categories have stopped quoting, and some exclusive part numbers have increased by more than 50%; Renesas delivery time is 20-24 weeks, and Qualcomm's delivery time is 25- 30 weeks; There are rumors that ON Semiconductor will stop accepting orders, and all product lines of power management ICs will extend the delivery period, some of which will be extended to 40 weeks; domestic Weimeng Electronics will raise its price again by 10%, suspend orders, and Jingfeng Mingyuan, Injixin, Silan Micro, Rockchip, Taiwan Lizhi, MediaTek Richtek Power IC product lines have all increased their prices.

Figure: Part of the original price increase letter for power management ICs

In terms of complete machine manufacturers, Lu Weibing, head of Xiaomi's mobile phone, said in February that chips are extremely lacking. Recently, there was news that Xiaomi had cut down many projects that had already been approved internally because of a shortage of materials from its suppliers. The main reason is that demand rebounded too fast in the second half of last year. Manufacturers were rushing for orders, but chip production capacity did not keep up. As a result, manufacturers who placed orders late had to buy goods at high prices. The supply of goods in the market is small, and after the inventory is exhausted, the lead time for re-ordering and scheduling is too long, and some items have to be reduced.

At present, TI has 12 fabs worldwide, accounting for half of the power management IC market shipments. Unlike other original factory agent distribution channels, TI has a large inventory of various manufacturing bases around the world, and its self-production rate is as high as 80%. , And has its own direct sales team around the world, a large number of orders are locked through acceptance of reservations and long-term agreements, and the original factory directly sells and ships. TI's product line has also begun to run out of stock and increase prices, which shows the overall shortage of materials.

Reasons for the price increase of power management IC: a surge in new materials

Power management IC includes AC-DC, DC-DC conversion, LDO, battery management IC, charging chip and switch IC, etc. Almost all chips and components need to manage voltage and current through power management IC.

FIG: Power Management the I C type , the source record of the branch channel

In terms of demand, in 5G base stations, 5G mobile phones, smart home appliances, TWS wireless headsets, wireless/fast charging chargers, battery-powered IoT devices, electric vehicles and charging piles, smart industry, smart security, PCs and mining machines, LED drivers, etc. In the market, China consumes more than 13 billion U.S. dollars in power management IC consumption a year.

Taking mobile phones as an example, a 3G mobile phone only needs 2 power management ICs, and a 4G smart phone requires 4-6 power management ICs. For example, there are 6 independent power management chips in the Samsung Galaxy S10+, 3 of which are dedicated to the camera and display. As the functions of 5G mobile phone modules become more complex, a 5G smart phone currently requires at least 8-10 power management ICs to manage the camera, display, RF, and overall circuit. Compared with 4G mobile phones, 5G stand-alone usage is 50% more.

For example, the iPhone 12 no longer presents a charging head. A large part of the reason is that Apple's self-developed power management IC is only sufficient for mobile phones, tablets and headphones. There is no remaining capacity, and the charging head can only be cut off. It is reported that full-speed charging can only be achieved with PD fast charging chargers of 20W and above. Both the mobile phone and the charger need to be equipped with fast charging chips, which generally include power supply main control IC, fast charging protocol control IC and synchronous rectification control IC. For mobile phones with fast charging function, a fast charging head increases the amount of 3 power management ICs.

In terms of communication base stations, on the one hand, 5G base stations require more antennas (more channels), more radio frequency components, and higher frequency millimeter waves, which all increase the consumption of power management ICs. 5G small base stations (within 1km coverage) need about 20 power management chips, medium base stations (within 3km coverage) need about 60 power management chips, and macro base stations need about 120 power management chips. Take Huawei as an example. Huawei not only developed its own power management IC, but also invested in third-party power management IC manufacturers to ensure its own material supply.

The popular TWS wireless headsets in the past two years are also the largest consumption of power management ICs. The charging solution for small products such as TWS wireless earphones includes charging chips, synchronous rectifier converters, low dropout regulators, and input overvoltage and overcurrent protection. It can be seen that a small TWS earphone consumes a lot of power management ICs. In addition, AIOT consumer electronics products such as popular educational tablets, smart sweeping robots, and smart homes all have a large demand for power management ICs.

In addition, a large number of power management ICs are also used in the multiple camera combinations of smart electric vehicles/autonomous driving, multi-screen control of the driving cabin, and fast charging module management. The amount of bicycles has increased significantly. Weilai Automobile is out of stock due to core materials such as ICs. , Resulting in the suspension of production of the model.

In addition, traditional security, PC, industrial, and LED power management ICs are large users. The new demand for fast and intelligent energy efficiency management in recent years is the biggest reason for the epic out-of-stock price increase of power management ICs this time.

TI, ADI, ON Semiconductor, and Renesas have eliminated 6-inch fabs

In terms of capacity supply, the original international power management IC manufacturers account for more than 80% of global shipments, and they are gradually phasing out mature process capacity, which has also put tremendous pressure on supply.

TI, Renesas, and ADI will successively close their 6-inch wafer fabs that produce analog ICs this year. The production capacity can only be transferred to 8-inch fabs or outsourced to third-party foundries. At present, a large number of 8-inch fabs have been locked in by other orders. , It takes time to digest the transfer order of the 6-inch fab.

Maxim sold its two wafer fabs a long time ago, including an 8-inch wafer fab in Texas sold to TowerJazz for US$40 million, and a research and development wafer fab in Silicon Valley for US$18 million. Give the apple. With the acquisition and integration by ADI, Maxim may also close some production capacity.

ON Semiconductor will also sell its 8-inch Niigata fab in Japan, and plans to close a 6-inch fab in Belgium.

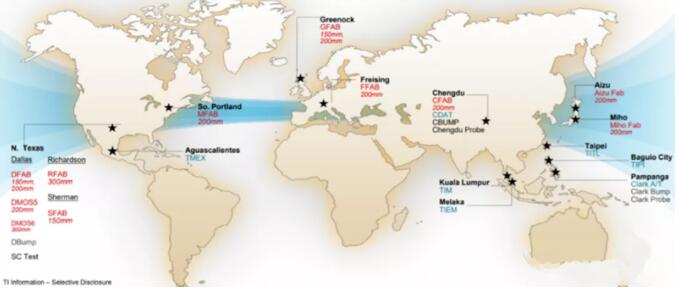

As of 2020, Texas Instruments has 14 manufacturing plants in the world, including 10 wafer manufacturing plants, 7 packaging and testing plants, and multiple bump processing and wafer testing plants. In 2010, Texas Instruments established its first wafer manufacturing base in Mainland China in Chengdu High-tech Zone. (Source: Zoth Automotive Research)

In terms of new capacity, ON Semiconductor has acquired most of the shares of Fujitsu’s 8-inch wafer fab in Aizuwakamatsu and the 12-inch wafer fab in East F14159265ishkill, New York, USA. Japanese company Mitsubishi Electric's new plant will double the overall power management chip production capacity. MediaTek Richtek acquired Intel's Enpirion power management business.

TI’s “cutting agents” aggravated the situation of roasted seeds and nuts

In terms of demand and capacity supply, power management IC inventory is facing tremendous pressure. In addition, the original factory pays more attention to the reform strategy of online distribution channels, which has also led to a sharp decline in market supply.

The biggest impact is during the National Day in 2019, TI announced the cancellation of the agency rights of the three well-known electronic component distributors Avnet, World Peace and Wen Ye, which took effect on December 31, 2020.

Figure: In the Americas, the current TI will Arrow, Avnet, Digi-Key, Mouser and Rochester Electronics as a distributor; in Asia, T the I sold through Arrow. In EMEA, Eastronics , MT Systems and Telsys have joined TI’s core global distribution roster. (Source: T the I 's official website)

TI has cancelled three offline agents that are deeply involved in Greater China. For downstream manufacturers, the tangible impact is the reduction of sourcing channels.

TI’s product line is huge, and the photocell management IC has as many as 130,000 product portfolios. Some companies that require small-volume spot purchases have to purchase TI’s products from traders at high prices due to reduced supply channels and long delivery times for orders. Materials, and in the environment where the industry’s materials are in short supply, the roasting phenomenon of TI material numbers frequently occurs, especially for individual high-end materials and exclusive materials, which have seen a 1000% price increase.

The current TI schedule is 20-24 weeks, and manufacturers who place orders at the beginning of the year will sign for receipt in Q2. The new products of power management Fabless placed in FAB will also gradually arrive, and the shortage of power management ICs is likely to be alleviated in Q3. Manufacturers in urgent need of materials can prepare inventory purchase plans in advance, and check the source information of each original manufacturer through online and offline channels. Don't buy refurbished materials cheaply. Check the goods carefully. If the production schedule is affected, the gain is not worth the loss.

Hundreds of domestic analog IC manufacturers gather for power management IC

The low-key analog IC market is very profitable. TI and ADI make good profits from the analog IC market every year. Power management IC shipments account for 25% of TI’s annual sales, with a gross profit margin of more than 60%.

At present, TI (NS) has 130,000 product categories, ADI (excluding Maxim) has 40,000 product categories, and Shengbang Micro, the best domestic analog IC product, has only 1,400 categories. The gap is still very obvious.

However, in the past two years, with the explosion of TWS headsets and fast charging, hundreds of local analog IC manufacturers have poured into the power management IC industry, and the road of domestic analog ICs has become wider and wider.

Well-known power management IC manufacturers include Shengbang, Chipeng Micro, Silan Micro, Silicon Lijie, Shanghai Belling/Nanjing Micro Union, Chip Smart, and Yutai Semiconductor. Fast charging ICs include Yichong Wireless, Injixin, and Zhonghui Chuangzhi. For gallium nitride fast charging, chip manufacturers such as Zhuhai Innosecco and Suzhou Quantitative Semiconductor have also begun mass production and shipment.

Take Shengbangwei as an example. The former supplier of power management IC for Huawei mobile phones and base station equipment has now become the manufacturer with the largest increase in the domestic analog IC product line. 1,400 types have entered the automotive industrial control medical category with high profit margins, accounting for 40% of the revenue.

In terms of TWS headsets, thanks to the large purchases of domestic TWS solution providers, Yutai’s monthly shipments are above 20KK. The Yutai ETA9640 solution was adopted by 11 brands including Edifier, Crazy Rice, and U&I, and entered the supply chain of JBL, Philips, and Anker. The sales volume of a single ETA9640 chip has exceeded 100 million, becoming a single chip for TWS headset charging box Top sales.

In terms of home appliance products, Chipeng Micro mainly supplies power management chips, with more than 500 models in production, which are used in downstream home appliances, standard power supplies, industrial drives, mobile digital and other fields. Customers include Midea, Gree, Philips, Supor, Joyoung, and ZTE. , Huawei, etc.

In terms of fast charging, Silijie high-power PD fast charging, the only local semiconductor company to enter the LLC controller market, focuses on the high-power solution PFC+LLC controller SY5055. In addition, Fast Charging IC Diao Micro received a joint investment from Xiaomi and OPPO.

At present, driven by the money-making effect of fast charging and TWS, the power management IC market has gathered a large number of IC design and sales talents. Hundreds of companies are fighting, basically Fabless manufacturers and solution providers. If IC shipments cannot be supported by upstream foundries, As well as the rising costs caused by the lack of materials, it is expected that a large number of companies will be eliminated. Companies with capital, market, and product competitiveness will grow rapidly.

Source from International e-commerce